Check out a selection of our recent Infographics to share with your clients, links to other useful sites and our Guide for Victims

Identity Theft is being fueled by Artificial Intelligence (AI) it’s an increasing threat and it’s scary…

Our increasing reliance on digital services for everything from banking to healthcare to government benefits demands a secure and trustworthy way to verify our identities online. Traditional methods like usernames, passwords, and even multifactor authentication are becoming vulnerable against AI-driven threats.

Top Reasons for Concern: a perceived increase in recent cyberattacks (55%), use of Artificial Intelligence (AI) technology (54%), and proficiency of today’s hackers (51%)

Recently, scammers armed with AI-generated deepfake technology stole around $25 million from a multinational corporation in Hong Kong.

You really need to become aware of how AI is impacting our lives and is a very real threat to our identities… Learn more…click on the button

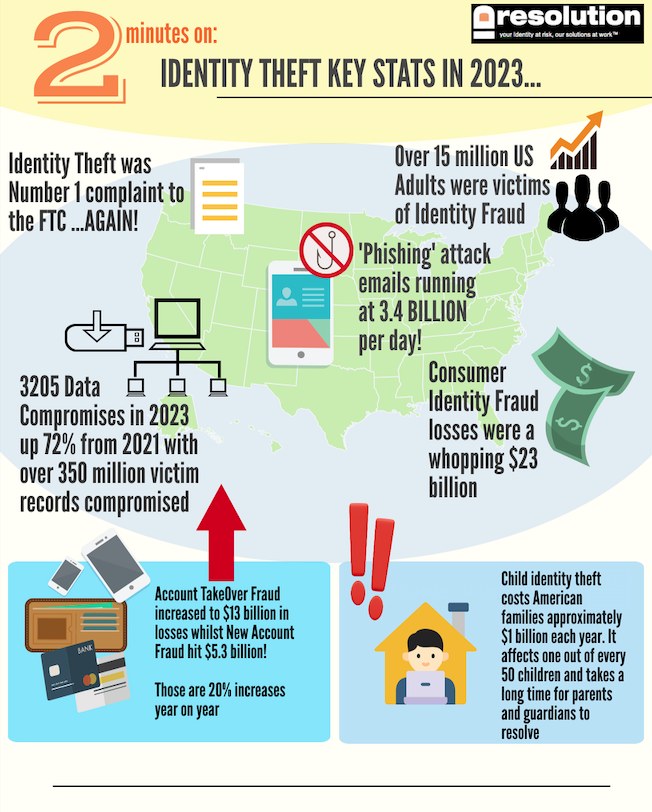

Identity Theft in 2023- Standouts and trends for 2024

2023 Once again produced some alarming numbers for Identity Theft and Fraud with consumer losses reaching $23 billion. Identity Thieves continue to be innovative and more and more sophisticated particularly with increased use of technology in phishing and social engineering attacks. Data Breaches reached a record number of compromises and the list goes on… Let’s take a deeper look…click on the button

Tax Season is here and so is IRS Identity Theft & Fraud…

Tax Season is in full swing and we need to be mindful of the dangers of IRS Identity Theft and Fraud… As Nina Olson from the Center for Taxpayer Rights said “It went from being a one-off thief ripping off someone’s Social Security number to a whole scheme and organized crime”

Let’s take a look at the issue and how we can keep ourselves safer with some do’s and don’ts. Theres also a couple of videos to watch and our PDF available for you to download and share. Click on the button…

The Emotional, Mental & Physical effects of identity Theft

Identity Theft Impact is not just financial – there can be great emotional, mental and physical side effects too.

Let’s take a look at this often overlooked issue…

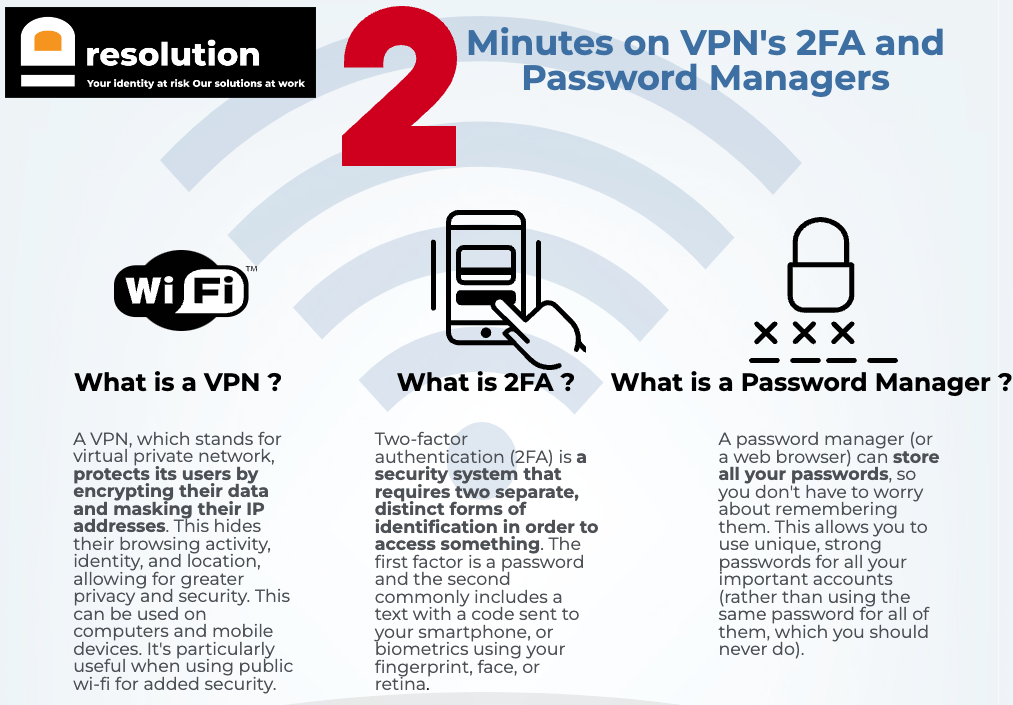

2 Mins on VPN’s 2FA & Password Managers…

It’s important to understand ways we can enhance our digital security and safeguard our personal information.

Virtual Private Networks, 2 Factor Authentication and Password Managers are all tools we can use.

Let’s take a brief look at each of them…Click on the button

Identity Theft… Victim Indicators

Identity Theft continues to be front and center in our daily lives. It’s the fastest growing crime in the US and the number one complaint to the FTC. There is no absolute protection from Identity Theft and in many instances it can happen multiple times. Early detection and action can prevent major escalation of the incident.

Vigilance, common sense and caution are key to the protection of our information and the reduction of the risk of it being used improperly. Yes it’s a pain to be constantly updating passwords, enabling 2FA and shredding paper statements BUT the outcome of not doing so can be very stressful and costly. Learn more by clicking on the button below…

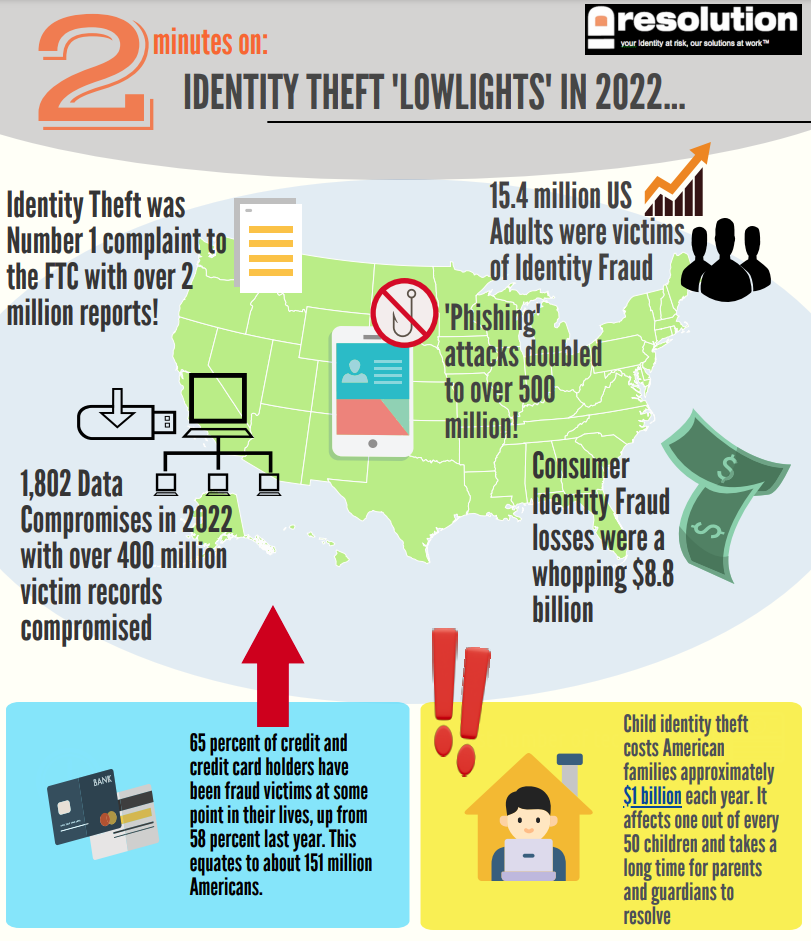

The “Lowlights” of Identity Theft & Fraud in 2022…

Identity Theft and Fraud are an ever-present in our lives. It’s not a matter of if, but when, we will become victims. We like to take an annual look at some of the trends and changes so let’s take a brief overview of the “Lowlights” for Identity Theft and Fraud in 2022. Click on the button below.

SIM Card Swapping and Fraud…

According to the FBI over $68 million was lost to SIM card fraud in 2021. A SIM swap can be particularly devastating because many internet services—including email, online banks, and online shopping websites—rely on mobile phone numbers to help users recover account access if they forget a password.

To learn more and to see watch a video of actual SIM Card fraud victims, click on the button below.

Account Takeover Fraud…

What is an Account Takeover Attack? Account takeover is a form of online identity theft in which a criminal illegally gains unauthorized access to an account belonging to someone else.

To learn more and to watch a video of victims of ATO, click on the button below.

Cash Transfer Scams including Zelle & Venmo…

Payment apps have made transferring cash more convenient than ever, but thieves are setting up Venmo & Zelle scams to steal your money!

Venmo and Zelle offer other layers of security, like PIN numbers and multi-factor authentication that make it more difficult for cybercriminals to access your account. But there is one security downside to using these services:

Unlike credit or debit cards, which offer financial protection for consumers in the case of fraud or theft, digital payment services like Zelle treat your money like cash. Once the money has been transferred to a scammer, it’s almost impossible to recoup the loss.

To Learn more click on the button below where you can also watch a video of victims who were defrauded…

WiFi – The Dangers Of “Free” Public Networks

We’ve all been there… airport lounge, coffee store, shopping mall, sports event…we want some wifi access to get onto the internet so we open our phone settings and see a “Free Wifi” access point.

It may seem legit, a store name or a business name and it has public access. BUT, are they who they say they are?

Is it real or is it a bogus access point set up by hackers to lure you in and steal your data?

Watch a video of a simulated hack by clicking on the button below

Learn more and download the complete pdf to share by clicking on the pic!

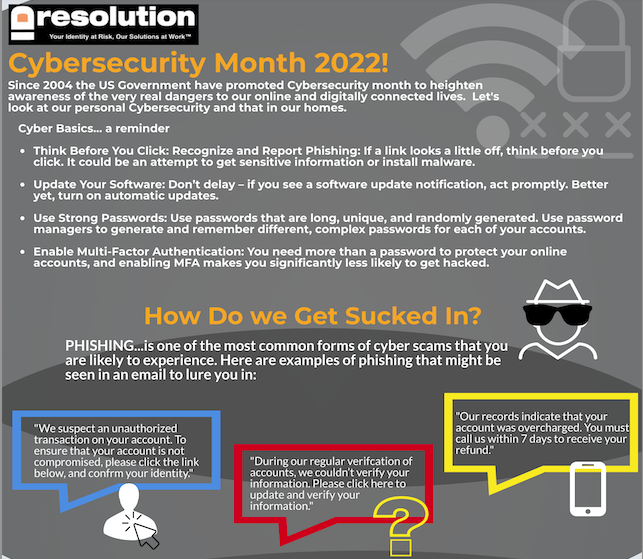

Cybersecurity Month 2022

Since 2004 the US Government have promoted Cybersecurity month to heighten awareness of the very real dangers to our online and digitally connected lives. Let’s look at our personal Cybersecurity and that in our homes.

Cyber Basics… a reminder

- Think Before You Click: Recognize and Report Phishing: If a link looks a little off, think before you click. It could be an attempt to get sensitive information or install malware.

- Update Your Software: Don’t delay – if you see a software update notification, act promptly. Better yet, turn on automatic updates.

- Use Strong Passwords: Use passwords that are long, unique, and randomly generated. Use password managers to generate and remember different, complex passwords for each of your accounts.

- Enable Multi-Factor Authentication: You need more than a password to protect your online accounts, and enabling MFA makes you significantly less likely to get hacked.

Learn more and download the complete pdf to share by clicking on the pic!

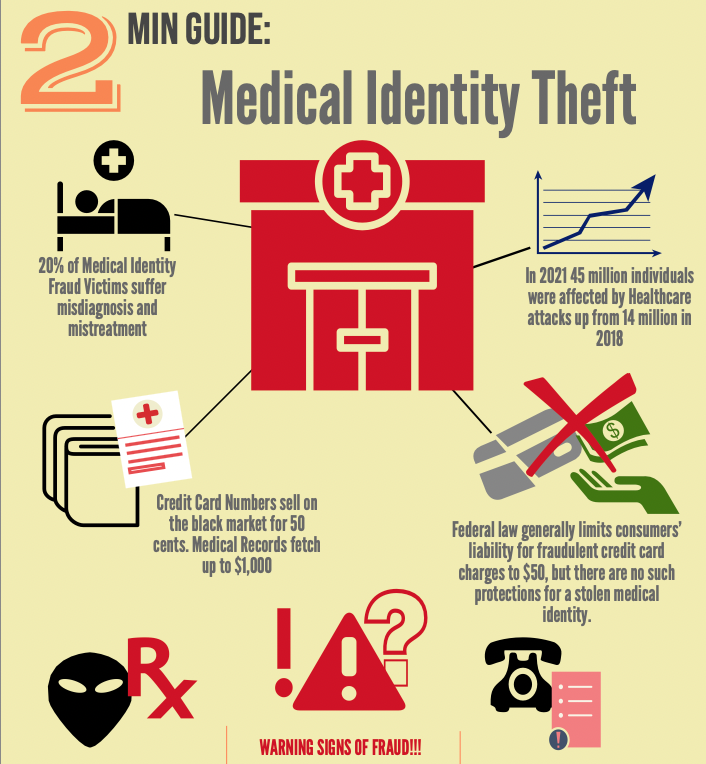

Medical Identity Theft

In 2021, 45 million individuals were affected by healthcare attacks, up from 34 million in 2020. That number has tripled in just three years, growing from 14 million in 2018

It’s a growing menace: Cases of medical ID theft reported to the Federal Trade Commission (FTC) rose from about 6,800 in 2017 to nearly 43,000 in 2021.

When someone steals another person’s medical information, they may use this medical identity theft to their advantage in several ways. They may ask to receive medical treatment, get health services, or fill prescriptions. It can cost far more than purely financial identity theft. Federal law generally limits consumers’ liability for fraudulent credit card charges to $50, but there are no such protections for a stolen medical identity.

Learn more and watch a video showing how a young Mothers life was turned upside down by Medical Identity Theft by clicking on the pic!

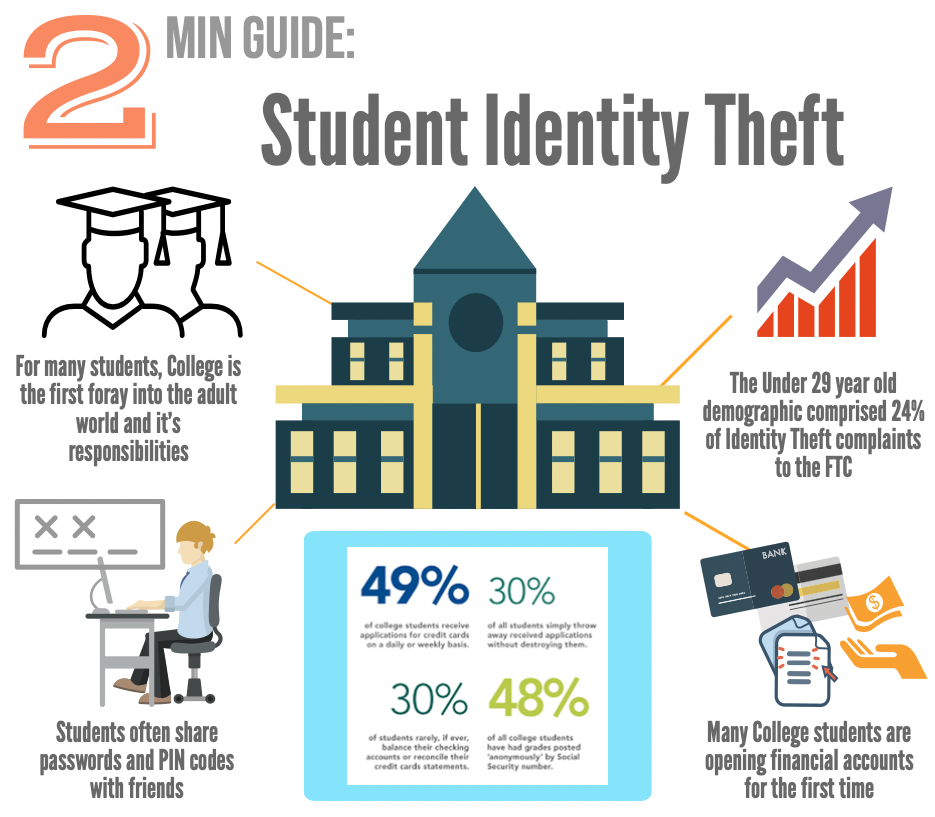

Student Identity Theft…

For many students, college is their first foray into an adult world full of newly realized responsibilities. Many are managing bank accounts and credit cards for the first time and paying and managing their various bills. This a world fraught with danger to their Identity and their financial and personal well being as they learn the importance of security regarding passwords, personal information online, use of social media, using unprotected Wi-Fi networks and more.

Let’s take a look at some of the issues:

- College freshmen are opening checking accounts, many for the first time, and getting their first credit cards.

- Most students haven’t developed the good habits they’ll need to stay safe. Students need to check bank and credit card statements regularly and often don’t.

- Students are massive users of smart phones and tablets. Mobile = Potential Danger.

- Students often use unsecured wireless networks when surfing the web.

- Students tend to be very trusting, sharing passwords and PIN codes with friends.

- Students are more likely than other people to fill out personal information that could be used by others to fake their identity.

- 98% of Students use multiple Social Media platforms daily. We share huge amounts of information there, not always wisely or securely!

To learn more, download our infographic and watch our cool animated video on the issue, click on the pic!

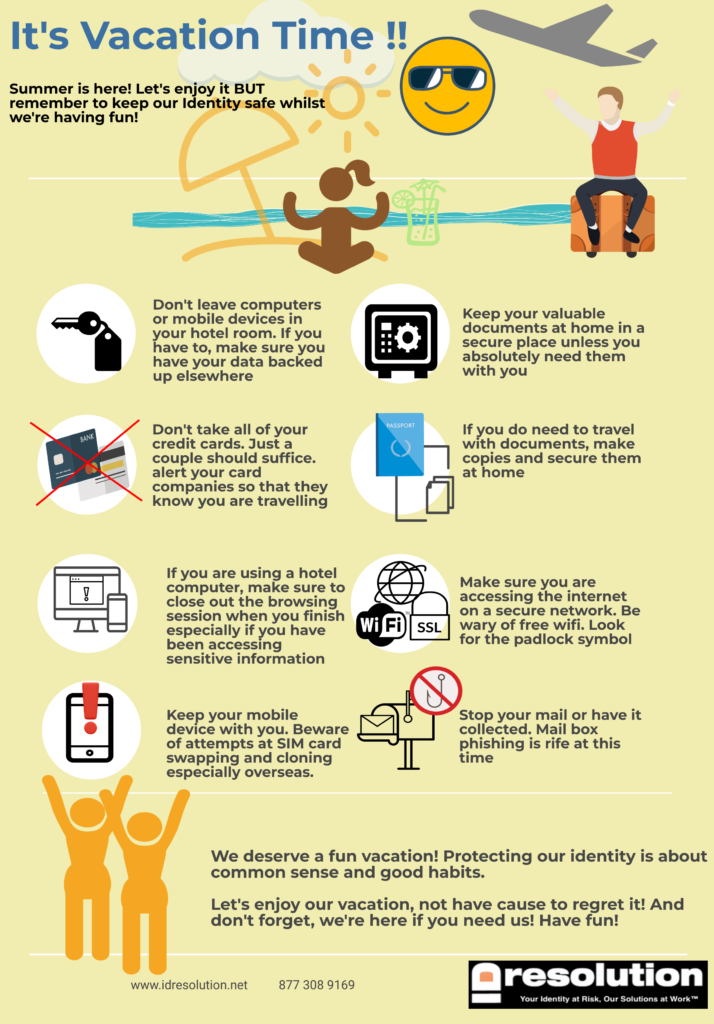

A Quick Tip Sheet for Vacation Season…

Summertime is fun time and whilst we deserve a great vacation, let’s not forget to keep our identity safe.

There are many simple ways we can do this and by using them we’ll hopefully avoid having the vacation turned into a nightmare!

Download our infographic to share with friends and colleagues by clicking on the pic!

Social Media continues its explosive growth in our personal and business lives…As always in the digital world, opportunities also bring dangers for misuse of our personal information

Social Media has become a major part of both our personal and business lives. We give out a lot of information freely. Whether interacting with friends and family or promoting our business their use has exploded over recent years.

Along with that growth there are significant risks to our personal information and how it’s used or misused. There’s a lot to understand and if we want to feel secure we need to be self informed.

Today, social media has many business uses as well: it’s is a common way for companies to market products and events, to keep abreast of industry and societal trends and interact with their client base.

Unconsciously (or sometimes, consciously), you provide personal details you would not share on your social media accounts. Information such as your full name (including your middle name), date of birth, hometown, pet names, interests and hobbies, nature of work, and home or office address are just some of the personal details you post on your profile. Criminals can easily manipulate these details to commit fraud. Protecting this information just as you would protect your SSN and driver’s license number is one effective method of identity theft prevention.

To Learn more, download our Infographic and to watch a couple of videos explaining the risks associated with Social Media in simple terms click on the pic!

Ransomware – What is it? How Can We protect Ourselves?

Ransomware is a type of malicious software, or malware, that prevents you from accessing your computer files, systems, or networks and demands you pay a ransom for their return. Ransomware attacks can cause costly disruptions to operations and the loss of critical information and data.

You can unknowingly download ransomware onto a computer by opening an email attachment, clicking an ad, following a link, or even visiting a website that’s embedded with malware.

Once the code is loaded on a computer, it will lock access to the computer itself or data and files stored there. More menacing versions can encrypt files and folders on local drives, attached drives, and even networked computers.

To Learn more, download our Infographic and to watch a video explaining Ransomware in simple terms click on the pic!

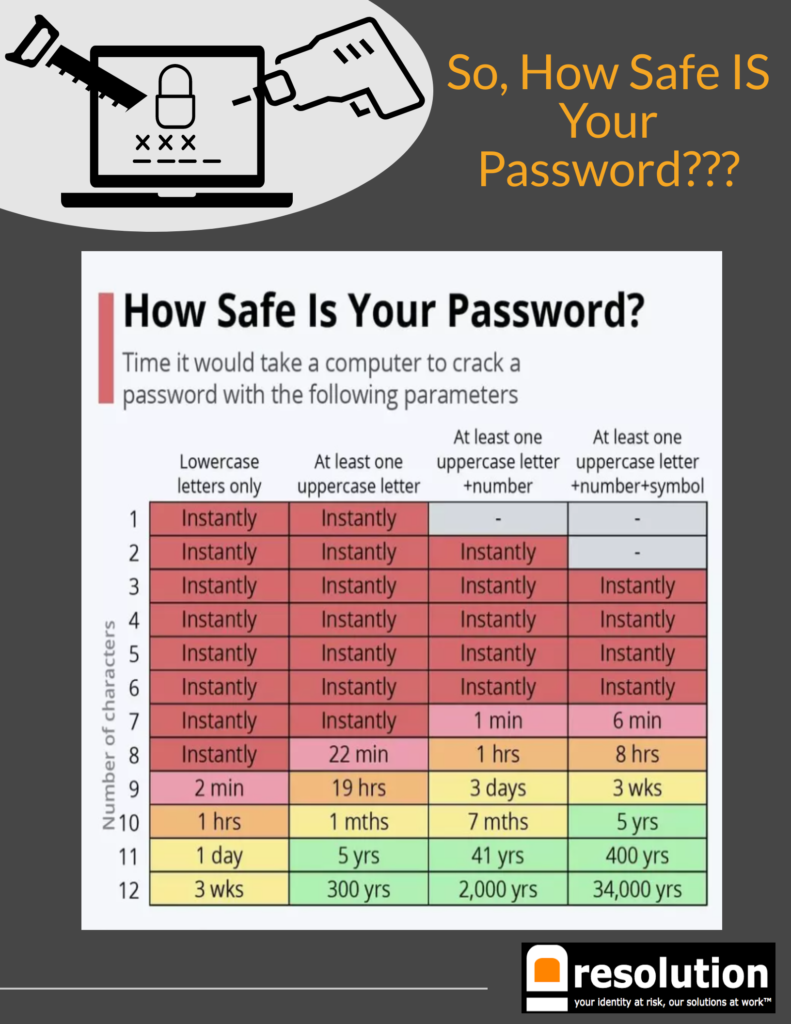

So, How Safe IS Your Password?

Passwords are the front door to your money, personal data, and secrets. More passwords mean more vulnerabilities. Unless you choose strong passwords, you are more vulnerable to cybercrime than most people.

A password of 8 standard letters contains 209 billion possible combinations, but a computer is able to calculate this instantly.

Adding one upper case letter to a password dramatically alters a computer’s potential to crack a password, extending it to 22 minutes.

Having a long mix of upper and lower case letters, symbols and numbers is the best way make your password more secure.

A 12-character password containing at least one upper case letter, one symbol and one number would take 34,000 years for a computer to crack.

Learn more by clicking on the pic!

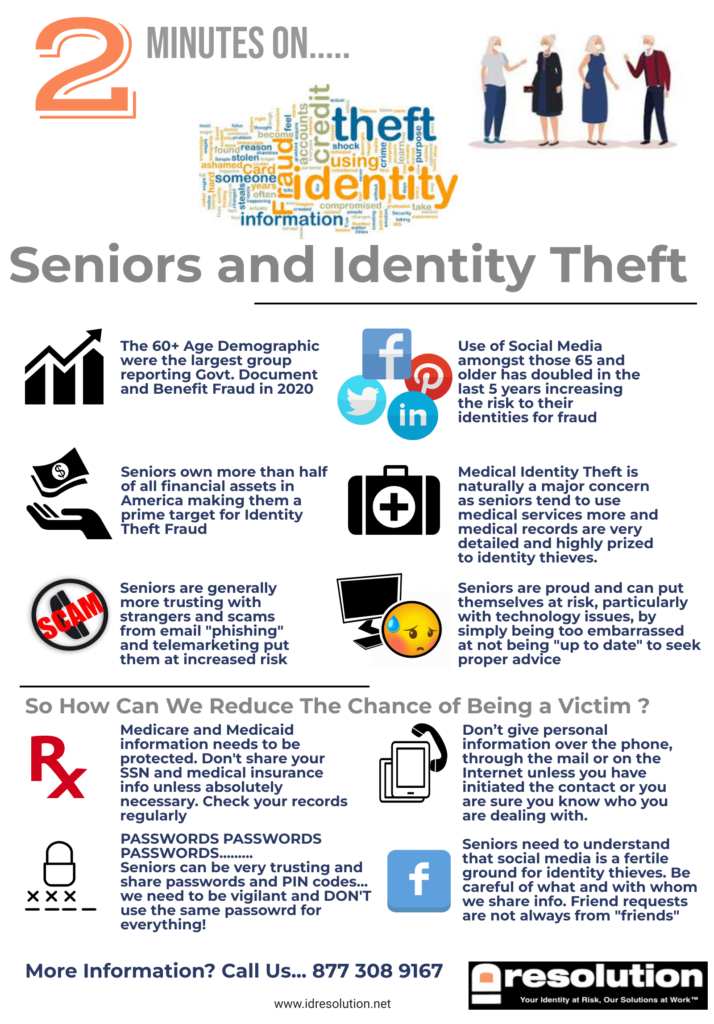

Seniors Are Very Vulnerable to Identity Theft. Why?

An aging population where seniors own over half of the financial assets in the country and nearly 3 times the average net worth of 35-44 year olds make them, unsurprisingly, especially attractive to identity thieves.

Rapid changes in technology and the use of technology by seniors just learning to adapt to its use is a major vulnerability.

During, and post Covid, many seniors have to get their information, benefits, shop, conduct financial transactions etc digitally rather than in person and no doubt this trend will continue. However, they may not have enough education about the dangers as well as the convenience of the digital world.

Learn more by clicking on the pic!

Mobile Device & Smartphone Security Threats

The most dangerous thing on our smartphone? OUR FINGERS! Clicking can expose us to a variety of threats….

Phone hacking and compromise can endanger your identity and privacy without you even knowing. Fraudsters continuously evolve and improve hacking methods, making them increasingly harder to spot. This means the average user might be blind sided by any number of cyber attacks.

The vast majority of Americans – 97% – now own a cellphone of some kind. The share of Americans that own a smartphone is now 290 million or 85%, up from just 35% in 2011.

Smartphones have brought our private and business accounts and their associated data into a single, convenient location — making our phones the perfect target for cyber criminals. Everything from banking to email and social media can be linked into your phone. Which means that once a criminal gets access to your phone, all your apps are open doors for cyber theft.

Learn more by clicking on the pic!

Check Out Our Guide For Victims

Our guide walks you through the process of Identity Theft repair and restoration. It also has do’s and don’ts to help keep you safer.

It’s a valuable tool!

Learn more by clicking on the pic!

Here Are Some Links To More Useful Information From Trusted Sources

Social Security

Learn more about Social Security Fraud and how to report it! Click on the icon for more information

FTC

The Federal Trade Commission is responsible for gathering Identity Theft reports and oversees Consumer Reporting Agencies. Click on the icon to learn more

DHSS

Learn about your rights under HIPPA and the handling of your medical records and information. Click on the icon to learn more

Opt Out Pre Screen

Want to Opt Out of junk emails offering credit or insurance? Click on the icon to learn more