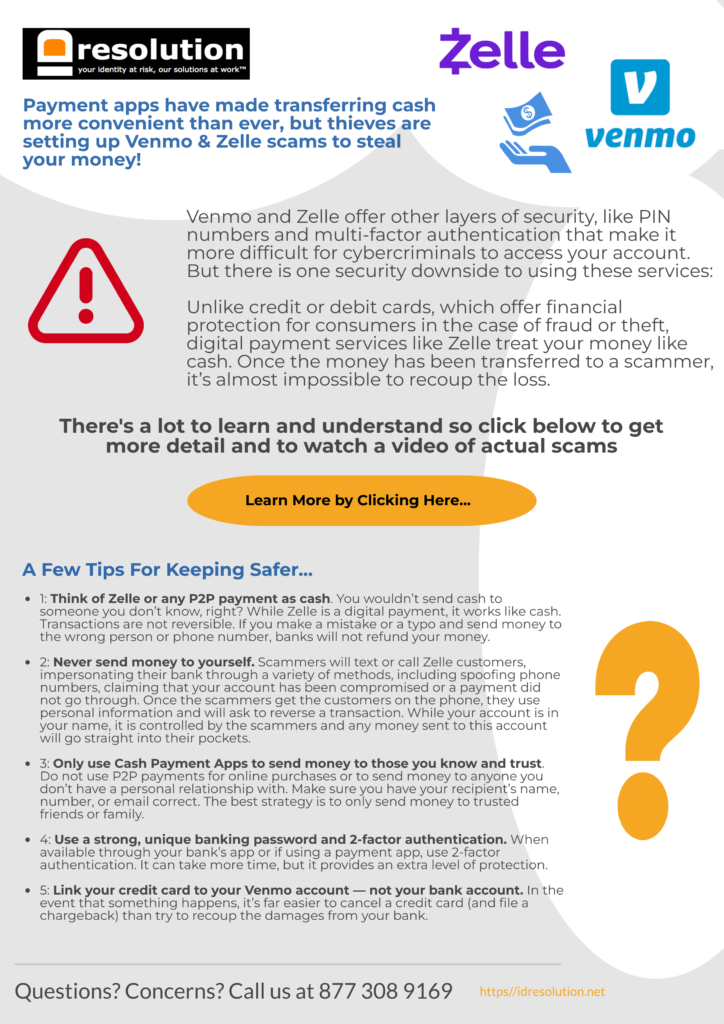

Payment apps have made transferring cash more convenient than ever, but thieves are setting up Venmo & Zelle scams to steal your money.

Last year, Zelle users transferred $490 billion using the payment app — making it a prime target for scammers. Unfortunately, peer-to-peer payment services like Zelle, Venmo and Cash App scams are only becoming more common. Fraudsters have learned how to take advantage of these apps to scam victims out of millions.

Venmo and Zelle offer other layers of security, like PIN numbers and multi-factor authentication that make it more difficult for cybercriminals to access your account. But there is one security downside to using these services: Unlike credit or debit cards, which offer financial protection for consumers in the case of fraud or theft, digital payment services like Zelle treat your money like cash. Once the money has been transferred to a scammer, it’s almost impossible to recoup the loss.

Will Venmo or Zelle Refund Money If You’ve Been Scammed? In most cases, the answer is no. However, if it can be proven that someone fraudulently accessed your account and device then it may be possible to get a refund. However if you directly make a transfer as part of a scam or just by mistake, it’s extremely unlikely you’ll get your money back. The companies don’t guarantee a refund if you have been scammed through their apps ! Payment platforms’ immediacy hinges on connecting your bank accounts or debit cards directly to the payment service. Unfortunately, this also means it’s nearly impossible to cancel a digital payment once it’s on its way.

Here are some common ways these scams occur:

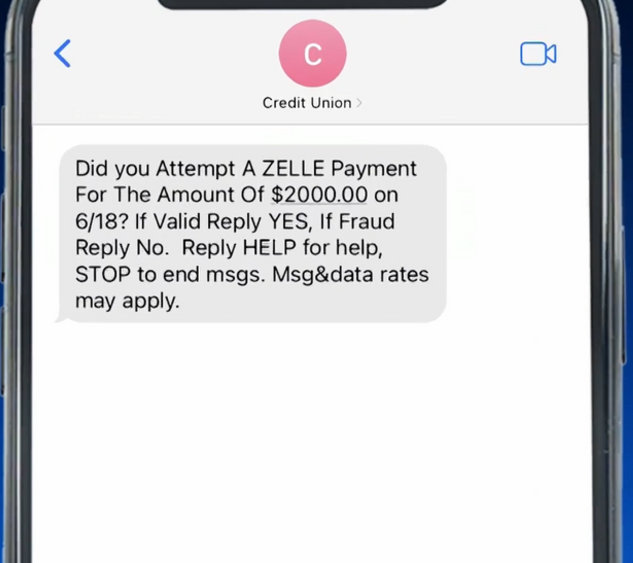

Account Takeover: Account Takeover Fraud is exactly what it sounds like-a scammer gets access to your Zelle account, changes the password, and locks you out. Account takeovers usually unfold the same way as phishing, spoofing, or smishing scams wherein the victim clicks on a phony login link.

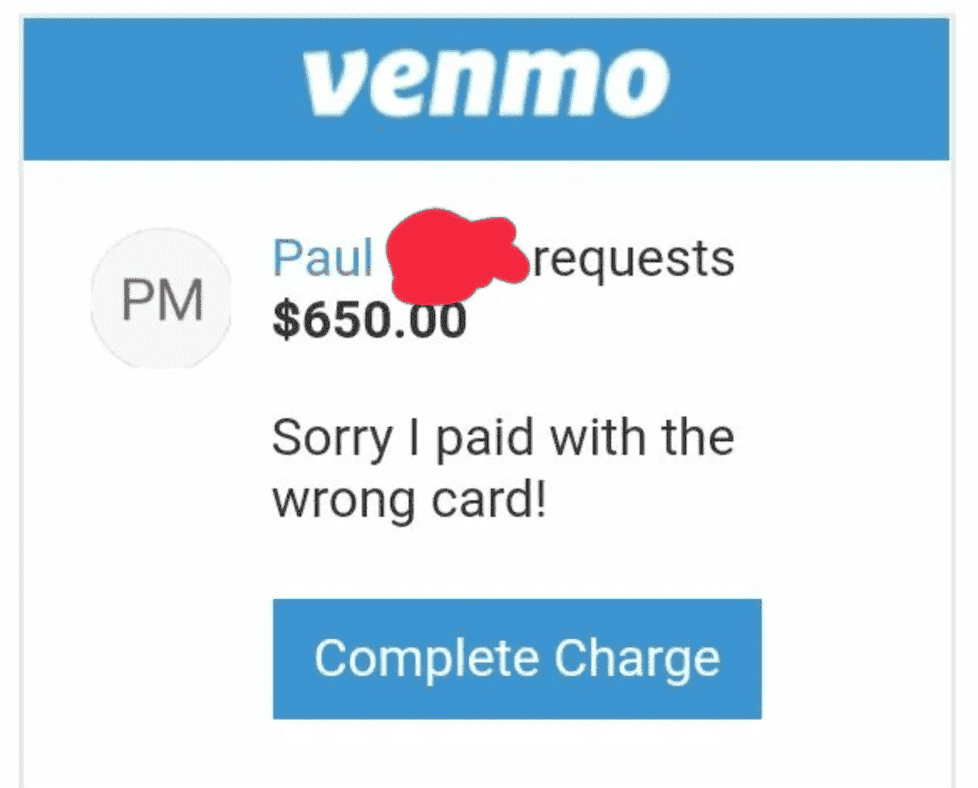

Accidentally sending you money: Receiving a random Venmo transfer is not always an honest mistake. In fact, scammers use this “high-tech twist on a classic con” to trick you into giving them money, according to the Better Business Bureau. The fraudster might use a stolen credit card or bank account number to transfer several hundred dollars to your account, then send you a message saying, “Oops! Can you send that back?” The money that you send goes to the criminal’s personal card.Here’s where things get sticky for you: When the original victim reaches out to their credit card company about the theft, the bank will reverse the charge, giving them their money back. At that point, the stolen funds will be removed from your account. You’ve lost money, and unlike the victim of credit card theft, you have no way to get it back.

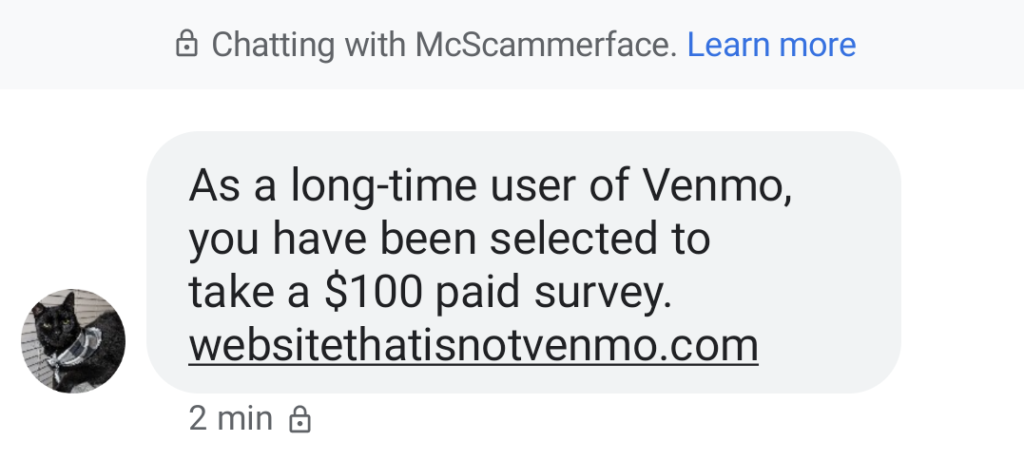

Requesting money with a fake link: Beware of unsolicited emails or text messages that look like notifications from Venmo. In a Venmo text scam, scammers may con you into clicking a disguised link inside a text message. It might hook you with the promise of free money for taking a quick survey or some other reward. While the text may appear to come from a legitimate Venmo account, the link will take you to a fake Venmo login page that steals your user data and financial information when you try to log in.

Impersonating Venmo or Zelle support: This popular phone scam hooks its victims by directing them to a fake website, which you may come across when googling “Venmo customer service.” On the site, you’ll find a phony phone number. Call it, and an identity thief will be waiting on the other end of the line, hoping to steal your money or hijack your Venmo account.The scammer might ask you for your Venmo login information or tell you to pay for the tech services by sending money to another Venmo account. In another twist on the scam, fraudsters posing as Venmo agents may ask you to send money to another Venmo account to verify your account. That money, as you may have guessed, goes into their pockets.

Pretending to be your friend and requesting money: Before accepting payment requests from friends, take a close look at their profiles. Some scammers create profiles that impersonate real people—and even go so far as to steal their usernames and profile pictures. With information found on the user’s public feed, these impostors will send requests to individuals who have sent or received money from the user in the past.

Before we move ahead to ways we can protect ourselves, take a look at this video highlighting some real examples of how people have been scammed…

How Can We Protect Ourselves?

- 1: Think of Zelle or any P2P payment as cash. You wouldn’t send cash to someone you don’t know, right? While Zelle is a digital payment, it works like cash. Transactions are not reversible. If you make a mistake or a typo and send money to the wrong person or phone number, banks will not refund your money.

- 2: Never send money to yourself. Scammers will text or call Zelle customers, impersonating their bank through a variety of methods, including spoofing phone numbers, claiming that your account has been compromised or a payment did not go through. Once the scammers get the customers on the phone, they use personal information and will ask to reverse a transaction. While your account is in your name, it is controlled by the scammers and any money sent to this account will go straight into their pockets.

- 3: Only use Cash Payment Apps to send money to those you know and trust. Do not use P2P payments for online purchases or to send money to anyone you don’t have a personal relationship with. Make sure you have your recipient’s name, number, or email correct. The best strategy is to only send money to trusted friends or family.

- 4: Use a strong, unique banking password and 2-factor authentication. When available through your bank’s app or if using a payment app, use 2-factor authentication. It can take more time, but it provides an extra level of protection.

- 5: Link your credit card to your Venmo account — not your bank account. In the event that something happens, it’s far easier to cancel a credit card (and file a chargeback) than try to recoup the damages from your bank.

Download our infographic to share with clients and friends and help educate them about the dangers…