In a world of relentless attack on our personal information, ID Resolution’s WRAP service for groups provides “one stop” comprehensive support in the event of identity theft and fraud.

It’s an incredibly affordable “must have” in any kind of group benefit package. The details are listed below but if you’d like us to talk you through it call us at 877 -308-9167

For each component of the WRAP you can view and download the associated pdf by clicking on the relevant button.

This program, which covers all immediate family members, offers assistance to those individuals who have had their personal information fraudulently used by identity thieves.

Experienced fraud resolution specialists can help resolve financial identity theft, criminal identity theft, and medical identity theft.

Victims of identity fraud will interact with one fraud specialist who knows the details of the case and who manages the case from beginning through final resolution.

Fraud Resolution….

The Fraud Specialist works with all creditors, agencies, law enforcement, professional associations, credit reporting agencies and collection companies. The Fraud Specialist also works with the victim when necessary, to place fraud alerts, credit freezes and suppressions with the three credit bureaus.

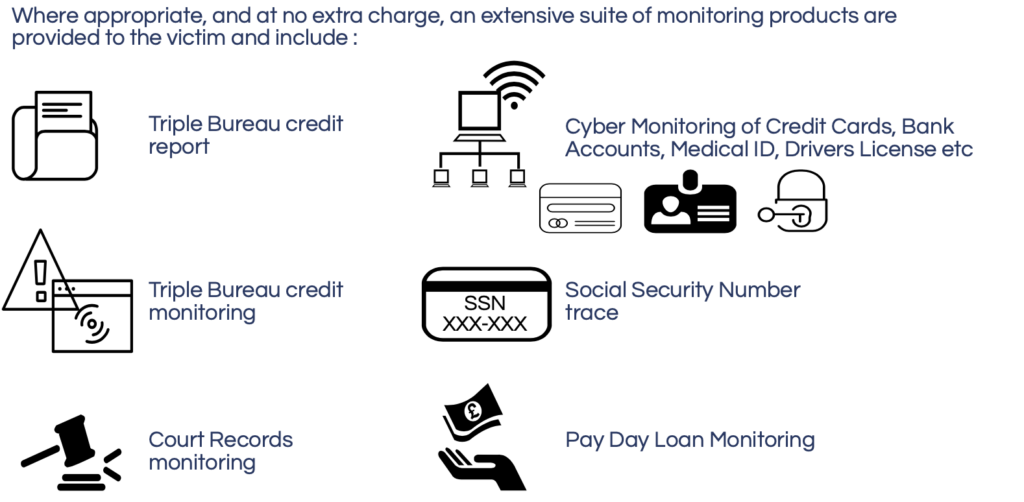

Where appropriate, and at no extra charge for a period of 12 months, an extensive suite of monitoring products are provided to the victim.

Among other Services included in the WRAP are……

Infant and Minor Identity Risk Mitigation

If you have children under the age of 18 we can find out if they have a credit file (they shouldn’t !) and make sure they are flagged as minors. Child identity theft is a very real issue.

Deceased & Estate Services

Unfortunately, every year 3 million deceased have their identities stolen. If you have a bereavement in the family, call us and we’ll help protect against identity fraud.

Personal Document Replacement Assistance

An advocate will assist in replacing sensitive personal identity documents, financial records, legal documents and other critical records.

Home and Auto Invasion

A person experiencing a home or automobile break-in is particularly vulnerable to identity related fraud as consequence of stolen documents/computers and/or compromised personal information.

Deployed Military Personnel Identity Risk Mitigation

An advocate can work with family members to review credit and personal information, add a protective Active Duty Military Alert on credit files, and remove names from pre-approved credit offers and personalized marketing for two years.

Relocation Services

We live in a transient society; in fact, over forty million Americans relocate each year. Students changing apartments, job relocation and millions of Americans buying second homes opens another window of opportunity for identity theft.