In 2021, 45 million individuals were affected by healthcare attacks, up from 34 million in 2020. That number has tripled in just three years, growing from 14 million in 2018

It’s a growing menace: Cases of medical ID theft reported to the Federal Trade Commission (FTC) rose from about 6,800 in 2017 to nearly 43,000 in 2021.

When someone steals another person’s medical information, they may use this medical identity theft to their advantage in several ways. They may ask to receive medical treatment, get health services, or fill prescriptions. It can cost far more than purely financial identity theft. Federal law generally limits consumers’ liability for fraudulent credit card charges to $50, but there are no such protections for a stolen medical identity

Why are Medical Records So Valuable to Identity Thieves? Because they contain a really comprehensive set of information about YOU! Name, age, SSN, payment history, possibly credit card and bank account information. They include every doctor’s visit you’ve made and every diagnosis you’ve received. They can’t be changed, they’re for ever. Additionally, it’s not just the financial aspects that are at risk. If our medical records have been fraudulently accessed, we may end up with a mixed medical record containing inaccurate information which can pose real dangers to our physical health.

Before we move ahead to some of the issues, take a look at this troubling video outlining the very real problems medical identity theft can cause.

Let’s Take a Look at Some of The Issues…

- Stolen medical data is 20–50 times more valuable than financial data

- It can cost far more than purely financial identity theft. Federal law generally limits consumers’ liability for fraudulent credit card charges to $50, but there are no such protections for a stolen medical identity

- A fifth of medical identity fraud victims experience misdiagnosis and mistreatment. According to a study by the Ponemon Institute, 20% of victims experience misdiagnosis and mistreatment due to incorrect information in their medical records. Many have also experienced delayed care, which could sometimes have a fatal outcome.

- It’s considerably harder to undo the damage. Many victims suffer long term problems with aggressive medical debt collection and severely impaired credit due to phony bills. Some have faced prosecution because thieves used their identities to fraudulently stockpile prescription drugs.

Stolen Medical Information Can Be Used to…

- Receive Treatment Fraudulently

- Fill Prescriptions

- Submit Fraudulent Expenses

- Obtain Medical Devices Fraudulently

- Be Reimbursed for False Claims

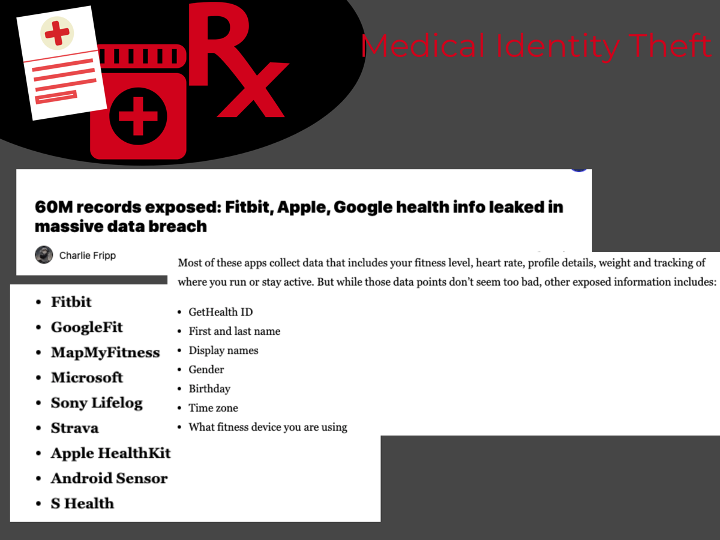

It’s Not Just Medical Records… Health and Fitness Apps are a Danger Too!

We live in a digital age and our information, including health information, is used and stored across multiple platforms. We need to be mindful of how much information we want to share and who is accessing it.

WARNING SIGNS !!!

- You get a bill for medical services you didn’t receive.

- You hear from a debt collector about a medical debt you didn’t incur.

- Your credit report includes health care expenditures you don’t recognize.

- An explanation of benefits (EOB) from your insurer or a Medicare Summary Notice includes office visits you didn’t make or treatment you didn’t receive.

- Your health plan says you’ve reached your benefit limit, citing treatment or services you did not get.

- Someone asks in a call or email for your Medicare or insurance number as part of a health care “survey” or offer of free medical products or services

How to Keep Safer… Do’s and Don’ts

- Do shred outdated insurance forms, physician statements, prescription paperwork and other documents containing medical information before throwing them out. Keep electronic copies of such records secure.

- Do carefully review EOBs, bills and other correspondence from insurers and medical providers. If you see anything suspicious, such as a doctor’s name or treatment date you don’t recognize, notify your insurer immediately.

- Do ask your insurer at least once a year for a full list of benefits paid in your name.

- Do check your credit reports thoroughly

- Do get copies of your medical files if you believe you’ve been victimized, and act quickly to correct mistakes. You have a right to get your records from health care providers, although you may have to pay for them.

- Do file a police report, and give copies to your medical providers, insurers and the credit bureaus. It can help protect you if an identity thief starts using your information for fraud.

- Don’t jump on offers of free health services or products, especially if accompanied by a request for your Medicare or health plan number.

- Don’t provide medical or insurance information over the phone or in an email unless you initiated the communication and are certain of whom you’re dealing with.

- Don’t give medical or personal information in response to an unsolicited call or email from someone who claims to be from Medicare. A Medicare representative will call only if you initiated contact.

- Don’t answer questions from a caller who says he or she is conducting a health survey and needs your Medicare or insurance number.

- Don’t give your insurance information to a family member or friend, even if it’s to help them get treatment. Whatever the intent, it’s considered fraud against medical providers and insurers.