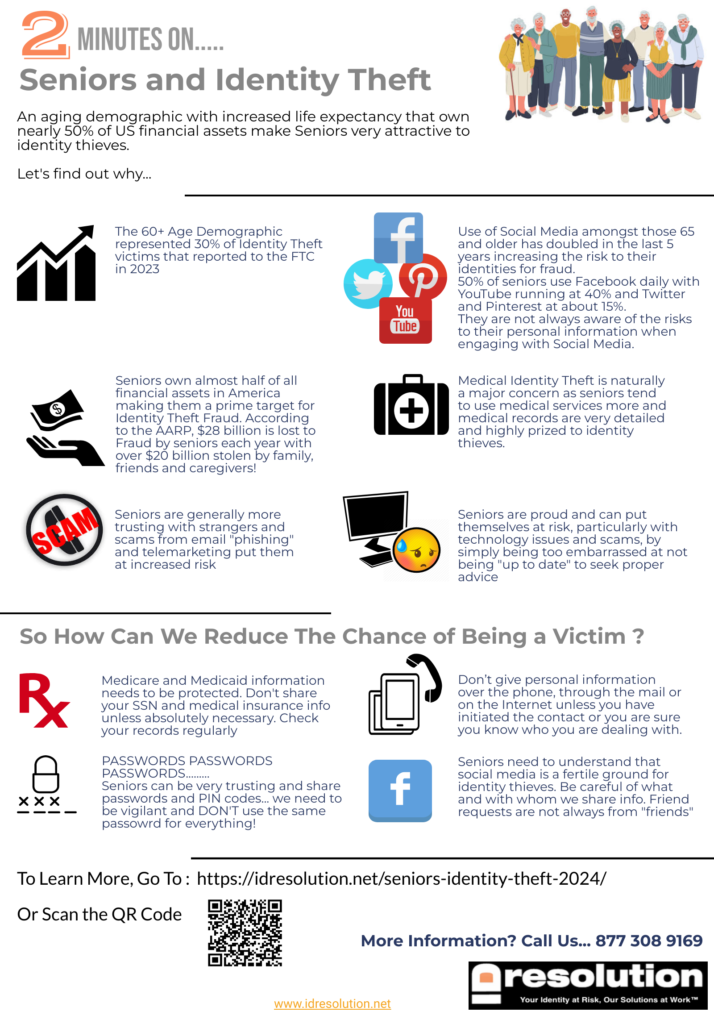

An aging demographic with increased life expectancy that own nearly 50% of US financial assets make Seniors very attractive to identity thieves. Let’s find out why…

In 2023, the 65 year old and over age group represented nearly 30% of all Identity Theft reports to the FTC making them the largest victim group. Why?

- Seniors own almost half of all financial assets in America making them a prime target for Identity Theft Fraud. According to the AARP, $28 billion is lost to Fraud by seniors each year with over $20 billion stolen by family, friends and caregivers!

- Seniors are generally more trusting with strangers and scams from email “phishing” and telemarketing put them at increased risk.

- Use of Social Media amongst those 65 and older has doubled in the last 5 years increasing the risk to their identities for fraud. 50% of seniors use Facebook daily with YouTube running at 40% and Twitter and Pinterest at about 15%. They are not always aware of the risks to their personal information when engaging with Social Media.

- Medical Identity Theft is naturally a major concern as seniors tend to use medical services more and medical records are very detailed and highly prized to identity thieves.

- Seniors are proud and can put themselves at risk, particularly with technology issues and scams, by simply being too embarrassed at not being “up to date” to seek proper advice

Common Risks for Seniors…

- Scams and Phishing Attacks: Fraudsters may contact seniors by phone, email, or mail, posing as legitimate organizations like banks, government agencies, or charities.

- Data Breaches: Seniors’ personal information can be exposed through breaches at medical facilities, financial institutions, or other organizations where their data is stored.

- Unsecured Technology: Older adults may use outdated or unsecured devices, making them more vulnerable to cyber-attacks.

- Mail Theft: Important documents containing personal information, such as bank statements or medical bills, can be stolen from mailboxes.

- Financial Exploitation by Caregivers or Family Members: Those close to seniors can sometimes misuse their personal information for fraudulent activities.

Methods of Identity Theft

- Impersonation Scams: Scammers pretend to be trusted individuals or organizations to extract personal information. Over 50% of seniors report being targeted by online scams, including phishing, tech support scams, and fraudulent websites, contributing significantly to identity theft incidents.

- Medicare Fraud: Fraudsters use stolen Medicare numbers to file false claims for medical services. A significant portion of identity theft among seniors involves Medicare fraud, where scammers use stolen Medicare information to file false claims. This type of fraud affects around 2.6 million seniors annually

- Social Security Fraud: Thieves use Social Security numbers to open new credit accounts or claim benefits.

- Investment and Lottery Scams: Scammers trick seniors into providing personal and financial information by offering fake investments or lottery winnings.

- Credit Card Fraud: Nearly 30% of senior identity theft cases involve credit card fraud, where thieves use stolen information to make unauthorized purchases.

- Bank Fraud: Seniors are often victims of bank fraud, which includes unauthorized withdrawals or transfers from their accounts.

- Tax-Related Fraud: Scammers use stolen Social Security numbers to file fraudulent tax returns, affecting thousands of seniors each year.

How Can We Try and Protect Ourselves?

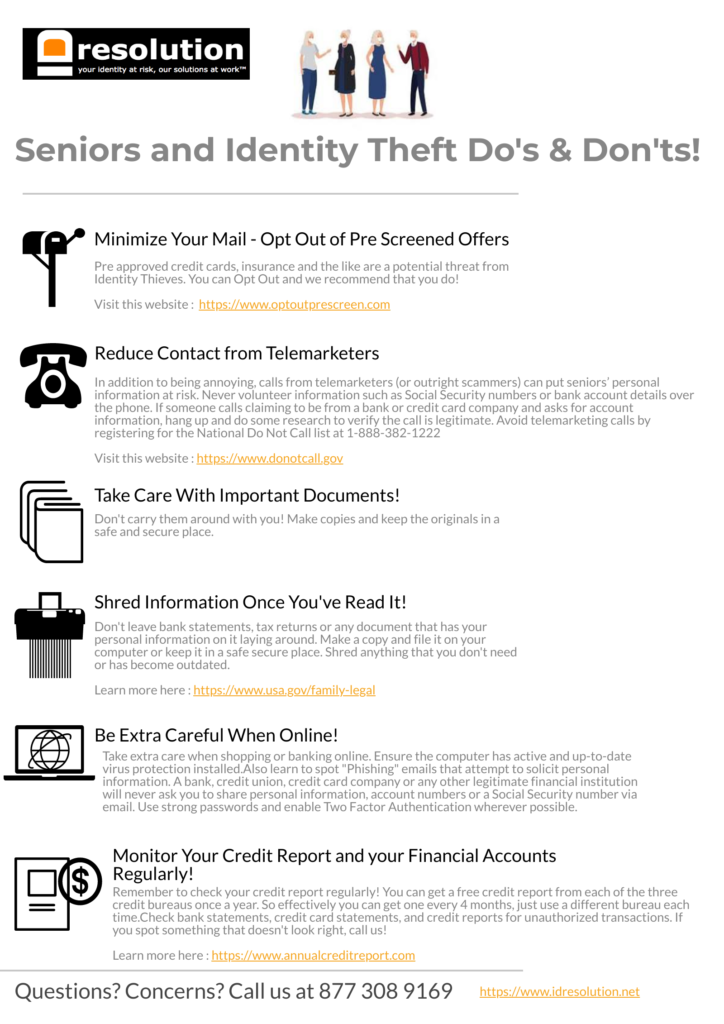

- PASSWORDS PASSWORDS PASSWORDS…Seniors can be very trusting and share passwords and PIN codes… we need to be vigilant and DON’T use the same passowrd for everything!

- Don’t give personal information over the phone, through the mail or on the Internet unless you have initiated the contact or you are sure you know who you are dealing with.

- Medicare and Medicaid information needs to be protected. Don’t share your SSN and medical insurance info unless absolutely necessary. Check your records regularly

- Seniors need to understand that social media is a fertile ground for identity thieves. Be careful of what and with whom we share info. Friend requests are not always from “friends”

- Shred sensitive documents before disposal and avoid sharing personal information over the phone unless absolutely certain of the recipient’s identity.

- Monitor Accounts Regularly: Check bank statements, credit card statements, and credit reports for unauthorized transactions

- Freeze Credit Reports: A credit freeze can prevent new accounts from being opened in a senior’s name without permission.

- Use Security Software: Ensure that their devices have updated antivirus software and firewalls to protect against malware and phishing attacks.

Download our Infographic and Do’s & Don’ts

Sources: Reuters, Forbes, Money, Sumsub, AARP, FBI, FTC