Identity Theft and Fraud are an ever-present in our lives. It’s not a matter of if, but when, we will become victims.

So what are some of the indicators that I may be a victim? Let’s take a look…

Identity Theft continues to be front and center in our daily lives. It’s the fastest growing crime in the US and the number one complaint to the FTC. There is no absolute protection from Identity Theft and in many instances it can happen multiple times. Early detection and action can prevent major escalation of the incident.

Vigilance, common sense and caution are key to the protection of our information and the reduction of the risk of it being used improperly. Yes it’s a pain to be constantly updating passwords, enabling 2FA and shredding paper statements BUT the outcome of not doing so can be very stressful and costly.

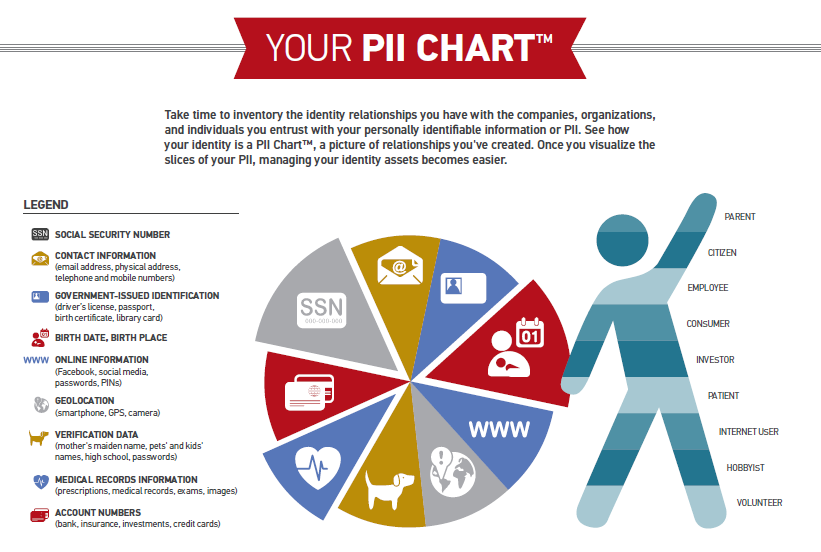

Our Personally Identifiable Information …PII

Our PII is effectively the DNA of our identity. We have information stored and disclosed in both paper and digital formats (think Social Security Card and then Social Media as examples). In the digital world we live in, that PII can be held on multiple platforms and for multiple reasons ( think Medical Records and on line banking as examples). How and why we give out various types of our PII needs our attention and thought. Here’s a great example of how our PII can be broken down.

So here are some of the many potential indicators of Identity Theft and actions we can take… As always, if you have concerns, call us!

New Loans or Credit Cards you didn’t apply for

You could learn about a new credit card through a letter in the mail, an email, or a phone call from the new lending company. But often, thieves associate the card with another address, and you won’t get notified. That’s why you should regularly check your credit history.

You’re denied credit

Did you apply for a new credit card or loan and think you were qualified but got denied? It’s possible somebody else is utilizing your credit for their own ends. Again, check your credit report and report any fraud.

Strange charges on your bank statement?

See some entries that look incorrect? How often do you check your statement? You need to do it regularly and if anything appears amiss, contact your financial institution immediately. Fraudsters may make small innocuous transactions to see if they can get away with it before committing larger fraud.

Calls from collection agencies

Getting lots of calls suddenly from debt collectors? You know it’s not you so you’re probably a victim and your information has been used to take out loans, make purchases and run up debt.

Medical bills you don’t recognize?

Why are you getting bills for treatment you didn’t have? It could well be that a thief is using your medical insurance information to get treatment and leave you to fight the bill. Check your insurance records regularly for claims. It may also leave you with limited benefits when you seek genuine treatment for yourself.

Unemployment benefits that you didn’t apply for

Your HR department calls you and says they’ve received a notice concerning unemployment benefits on your behalf. Clearly it’s not you! Identity thieves have gotten your information and have falsely claimed benefits. Contact the department of labor and with your company, report the fraud.

Online account verification requests

Getting calls or texts asking you to verify account details? Don’t do it! Don’t give out any information. Call the service provider directly and ask them if they called you. Phishing is one of the most prevalent and dangerous forms of identity theft we face today.

Receiving unexpected 2FA (two factor authentication) codes

If you receive a text containing a verification code you did not request, that may mean a thief has deciphered your account password and is attempting to access your account. A password that is compromised should be changed immediately. Contact the institution involved immediately.

IRS income tax fraud and discrepancies

Identity thieves often steal your identity by reporting income that does not belong to you and then cashing in on a tax return. Look out for notifications that a tax return has been filed under your name. Additionally, if you receive a W-2, 1099, or any other tax form from a company you’ve never worked for, it might mean that someone obtained your Social Security number and is using it for employment purposes.

Here’s a video to remind us of what a Phishing attack is…

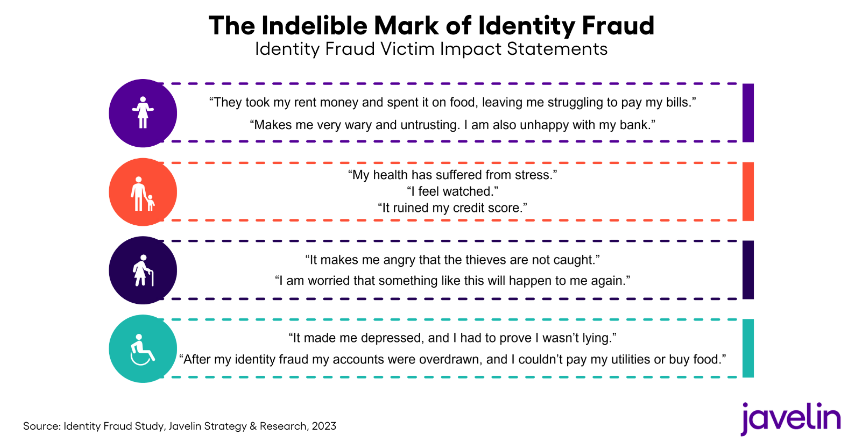

If you think that Identity Theft is still a vague concept that has only minimal impact, take a look at some Victim Statements from a recent Javelin study…