Many people think that Credit Cards and Debit Cards offer the same protections in the event of fraudulent use.

They DON’T! Let’s learn more…

Firstly let’s look at Debit Cards...

Financial institutions assume that as the debit card has a unique PIN supposedly known only to you, that YOU are using the card and thus initiating the transaction in good faith. Transactions are linked to, and are directly deducted from your checking or savings account immediately.

There is no “line of credit” involved as there is with a credit card, you either have enough funds in your account to cover the transaction or you don’t.

Because there is no intermediary credit card issuer involved, YOU are responsible for checking your accounts for any kind of fraudulent transaction and the penalties and potential outcomes are very different from fraudulent Credit Card activity.

There are notification periods within which penalties are imposed:

Under the Electronic Fund Transfer Act (EFTA), your liability depends on when you report the fraud:

- Within 2 days: Maximum loss is $50.

- After 2 days but within 60 days: Maximum loss is $500.

- After 60 days: You could lose everything in your account.

Since debit card fraud pulls money directly from your bank account, it can take longer to recover funds.

And now Credit Cards…

Credit Cards have an attaching line of credit (credit limit) that is tapped into when you use the card. Since purchases are made using the bank’s money (credit), the bank is more motivated to quickly investigate and reverse fraudulent charges.

Credit Cards: Protected by the Fair Credit Billing Act (FCBA)

- Limits your liability for fraud to $50 (most issuers waive this, making it $0).

- Fraudulent charges are reversed immediately, and you don’t have to pay while the bank investigates.

- Transactions are processed later, giving time for fraud detection before you’re billed.

Key Take Aways…

Here are some points to consider as it relates to fraud recovery for debit and credit cards. As always, we need to be vigilant in checking our accounts and statements regularly and remember, with a debit card you could lose ALL your money if you don’t report the fraud within 60 days!

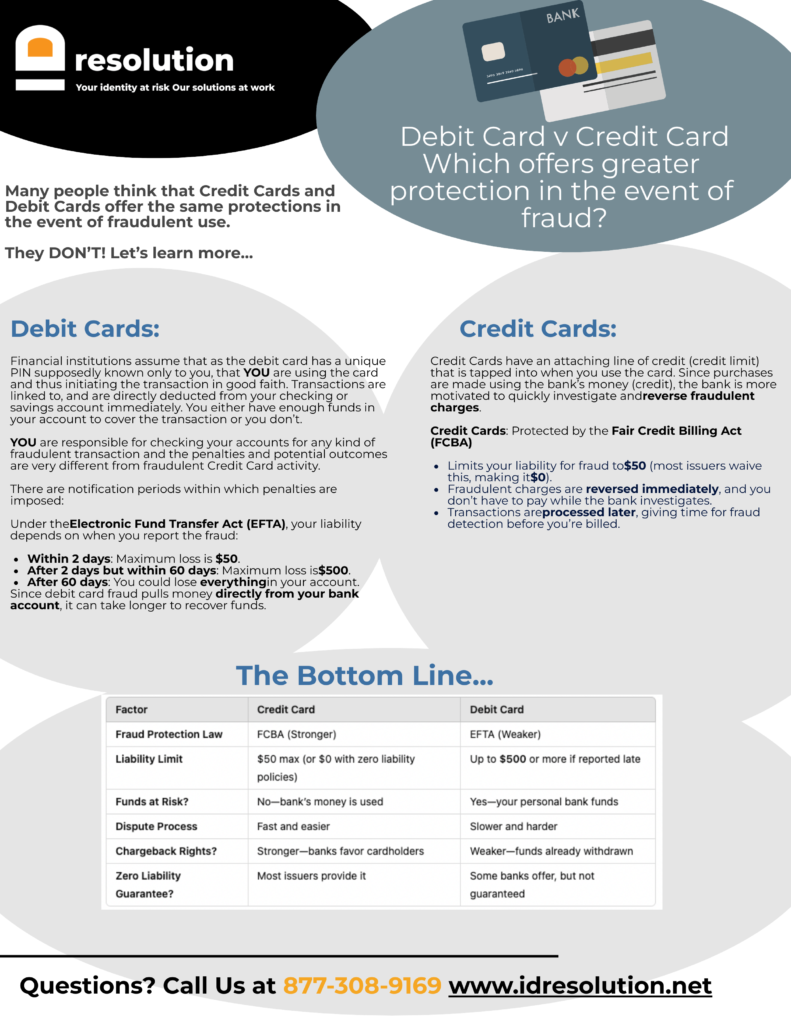

| Factor | Credit Card | Debit Card |

|---|

| Fraud Protection Law | FCBA (Stronger) | EFTA (Weaker) |

| Liability Limit | $50 max (or $0 with zero liability policies) | Up to $500 or more if reported late |

| Funds at Risk? | No—bank’s money is used | Yes—your personal bank funds |

| Dispute Process | Fast and easier | Slower and harder |

| Chargeback Rights? | Stronger—banks favor cardholders | Weaker—funds already withdrawn |

| Zero Liability Guarantee? | Most issuers provide it | Some banks offer, but not guaranteed |

You can open and download the infographic to share with colleagues and clients by clicking on the button…

Sources: Javelin, FBI, FTC