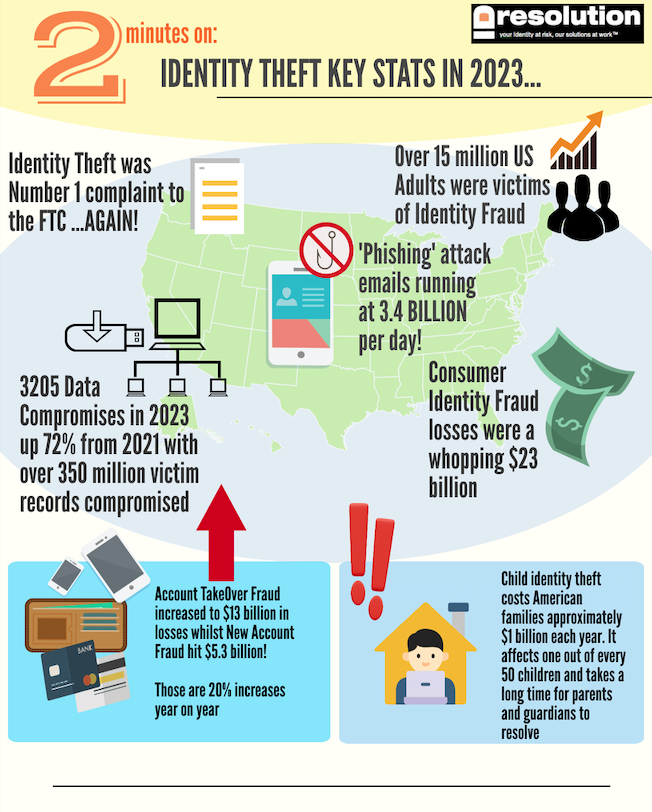

2023 once again produced some alarming numbers for Identity Theft and Fraud with consumer losses reaching $23 billion. Identity Thieves continue to be innovative and more and more sophisticated particularly with increased use of technology in phishing and social engineering attacks. Data Breaches reached a record number of compromises and the list goes on… Let’s take a look

2023 once again showed the ongoing scale of Identity Theft and Fraud. The techniques employed and target areas change but the issue persists and we are all at risk. Let’s take a look at some of the key statistics…

- Identity Theft continues to be the Number 1 complaint to the Federal Trade Commission with more reports than any other category

- There were over 15 million US adult victims of Identity Theft and Fraud in 2023

- Phishing emails were running at 3.4 billion per day! The increasing use of AI (Artificial Intelligence) is producing more sophisticated, nuanced and personalized messages that create increased danger to the receiver. In essence they are looking more and more like genuine messages that incline us to open/respond and then, hey presto, the damage is done. Over 25% of identity fraud was instigated via email.

- Consumer Identity Fraud losses were around a staggering $23 billion. $4billion of these were related to investment/crypto currency scams. Account Takeover scams (whereby an already “open” account is fraudulently used) were up 20% to $13 billion and New Account Fraud increased nearly 30% to $5.3 billion

- Social Media continues to be a key access point for identity theft. The amount of information we freely share enables fraudsters to build and use our profiles in their activities. Pictures, geo-location, friends etc etc coupled with the power of AI makes this an increasingly rich hunting ground and we need to be mindful of what and with whom we share our activities.

- Data Breach compromises reached a record 3205 events with 350 million victim records compromised. Healthcare as an industry suffered the highest number of breaches. Why? Because healthcare information is the most valuable on the black market to cyber criminals. They are probably the most complete set of records about an individual with not only SSN, addresses, health insurance information etc but also our medical make up. Prescriptions, medical devices etc are included and so the potential for fraud is magnified across many different areas. It also takes way longer for any fraud to be detected because unlike say, financial records, there is nobody monitoring these for suspicious “transactions”. We need to actively monitor our records ourself to remain safe.

To download our PDF to share click on the button. Visit the “Useful Stuff” area of our website for more related topics and information

Trends for 2024…

- AI – We expect AI to continue to have a major and growing impact on the way identity thieves look to manipulate us via phishing/smishing and voice scams. It’s also going to increasingly have an impact on social engineering and social media. This technology is a rollercoaster of positives and negatives but it’s here to stay and it’s big. Stay tuned, we’ll be writing more about this in the future.

- Social Media as a gateway for fraud. As the number, size and popularity of platforms change one thing is a constant and that is the amount of our personal information that is in the digital world. Remember, that data exists forever! It’s stored somewhere and is vulnerable to fraudulent use.

- Medical Identity Theft. As we said earlier, these records are valuable. We expect continued attacks on the healthcare sector. We really do have to take personal responsibility here and CHECK OUR RECORDS! If anything looks amiss, report it straight away to providers and insurance companies.

How can you minimize the chance of becoming a victim?

- Don’t carry your Social Security card or any document(s) with your SSN on it.

- Don’t give a business your SSN just because they ask. Give it only when required.

- Protect your financial information.

- Enable 2FA wherever possible

- Check your credit report at least every 12 months.

- Secure personal information in your home.

- Protect your personal computers by using firewalls, anti-spam/virus software, update security patches, and change passwords for Internet accounts.

- Don’t give personal information over the phone, through the mail or on the Internet unless you have initiated the contact or you are sure you know who you are dealing with.

- Be careful who you interact with on Social Media and what you post

- Check your Medical Records regularly